| Size of the Industry | A modern wind turbine consists of about 8000 unique components and such components of related services are supplied by an estimated 25 to 30 highly specialized companies in India |

| Geographical distribution | Andhra Pradesh, Gujarat, Kerala, Maharashtra, Rajasthan and Tamil Nadu |

| Output per annum | Growth in the market for (steam & hydro) turbines has been uneven - average growth 7 % per annum. |

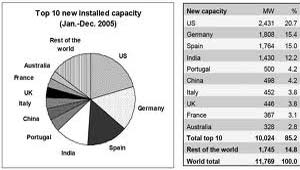

| Percentage in world market | India currently is the 4th largest generator of wind energy in the world with an installed capacity of 8698 MW |

| Market Capitalization | CAGR of 7% for steam turbines |

India's agenda include high Energy security and sustainable development. The reasons are due to volatile energy prices, high demand for energy, security and concerns over environmental sustainability and the global climate change. With proper incentives wind energy India would meet over 24 % of energy needs by 2030 according to Global Wind Energy Council (GWEC) and the Indian Wind Turbines Manufacturers Association (IWTMA). The growth trends of wind power development in six Indian states like Andhra Pradesh, Gujarat, Kerala, Maharashtra, Rajasthan and Tamil Nadu indicate that more than 90 % of wind energy potential prevails in India which could be exploited by 2030. Need for installation of high powered wind turbines to replace old turbines and lower capacity machines, development of offshore wind farms and development of hybrid turbines are some of the factors leading for the rapid growth of wind industry in India. In 1990's the development of wind power in India began and has significantly increased in the last few years. India is home to one of the world's largest wind power companies. Suzlon Energy. Suzlon is the largest wind turbine manufacturer in Asia (5th worldwide) and operates a 584 MW wind park in the Western Ghats-Tamil Nadu- the state with the most wind generating capacity and the largest wind park in the world.

India today has a well developed manufacturing base which includes global leader Suzlon, accounting for over half of the market. Some of the leading Indian and global companies in this industry are Vestas, Wind Tech, Repower, Siemens, and LM Glasfiber, RRB, Enercon, and the new entrants such as ReGen Power Tech, WinWinD, Kenersys, and Global Wind Power.

Today there is a huge demand for sophisticated equipment manufactured by International wind energy equipment manufacturers. A modern wind turbine consists of about 8000 unique components and such components of related services are supplied by an estimated 25 to 30 highly specialized companies in India along with the large number of international suppliers. Indian wind turbine manufacturers provide operation and maintenance support and also monitor the field performance of the wind turbines installed by them.

Increasing competitive pressures in Indian Turbine business due to the reduced import duties, larger number of suppliers and substitute products.

- Estimated imports FY 98: Rs 40 cr (US$ 9.3 mln). Imports mainly are the gas turbines and large (> 100 MW) hydro turbines. While the Major imported brands - Solar, EGT, AGC, Kawasaki. Indian companies directly import turbines from principals like Thermax Pune from Ansaldo Italy, Agro Products Delhi from LMZ Russia. Import duty on all turbines: 25% basic + 2.5% surcharge +16% countervailing duty + 4% special additional duty.

- Estimated exports of turbines (FY98): Rs. 20 cr (US$ 4.7 mln)

- ABB

- BHEL

- DLF Energy Systems

- Triveni Engineering.

- Suzlon

- Siemens

- Recently Indian government had an agreement with the USA on the licensed manufacturing of a family of General Electric LM2500 gas turbines using production capacities of the state corporation HAL.

- Naval versions of the turbines are planned to be installed on the aircraft carriers of the Air Defense Ships class, which are being started up at the dockyards in Kochin. Besides, Indian shipyards received a government order to build frigates of the 17 Shivalik projects of 5000 tons, which are also planned to be equipped with LM2500 engines. Today total up to forty turbines at the cost of USD 1 billion will be required to equip three aircraft carriers and twelve frigates.

- Recently Russia signed a contract for supply to India in 2007 of 200 low-sized engines manufactured by scientific-industrial association "Saturn" for "Lakshia" unmanned aircrafts. The cost of the transaction came up to about USD 100 million. The engine for India will be developed on the basis of the low-sized engine TRDD-50MT, which has been originally designed for the Russian cruise missiles.

- India is depended on heavily on coal, so in order to reduce their dependence on this polluting fossil fuel, the Ministry of New and Renewable Energy (MNRE) is aiming to have 6,000 MW of additional wind power capacity installed by the year 2012. Moreover, companies as well as individuals will get tax breaks for investing in green energy, especially wind farms.

- Despite the fact that wind power accounts for 6 % of India's total installed power capacity it only generates 1.6 % of the country's power. For this reason, the government is considering the addition of incentives for ongoing operation of installed wind power plants.

Recent Press Release

Recent Press Release

INDIAN turbine Industry AT A Glance IN 2021 - 2022

INDIAN turbine Industry AT A Glance IN 2021 - 2022

INDIAN turbine Industry AT A Glance IN 2020 - 2021

INDIAN turbine Industry AT A Glance IN 2020 - 2021

INDIAN turbine Industry AT A Glance IN 2019 - 2020

INDIAN turbine Industry AT A Glance IN 2019 - 2020

INDIAN turbine Industry AT A Glance IN 2018 - 2019

INDIAN turbine Industry AT A Glance IN 2018 - 2019

INDIAN turbine Industry AT A Glance IN 2017 - 2018

INDIAN turbine Industry AT A Glance IN 2017 - 2018

INDIAN turbine Industry AT A Glance IN 2016 - 2017

INDIAN turbine Industry AT A Glance IN 2016 - 2017

INDIAN turbine Industry AT A Glance IN 2015 - 2016

INDIAN turbine Industry AT A Glance IN 2015 - 2016

INDIAN turbine Industry AT A Glance IN 2014 - 2015

INDIAN turbine Industry AT A Glance IN 2014 - 2015

INDIAN turbine Industry AT A Glance IN 2013 - 2014

INDIAN turbine Industry AT A Glance IN 2013 - 2014

INDIAN turbine Industry AT A Glance IN 2012 - 2013

INDIAN turbine Industry AT A Glance IN 2012 - 2013

INDIAN turbine Industry AT A Glance IN 2011 - 2012

INDIAN turbine Industry AT A Glance IN 2011 - 2012

Indian Industries

INDIAN TURBINE INDUSTRY

INDIAN TURBINE INDUSTRY